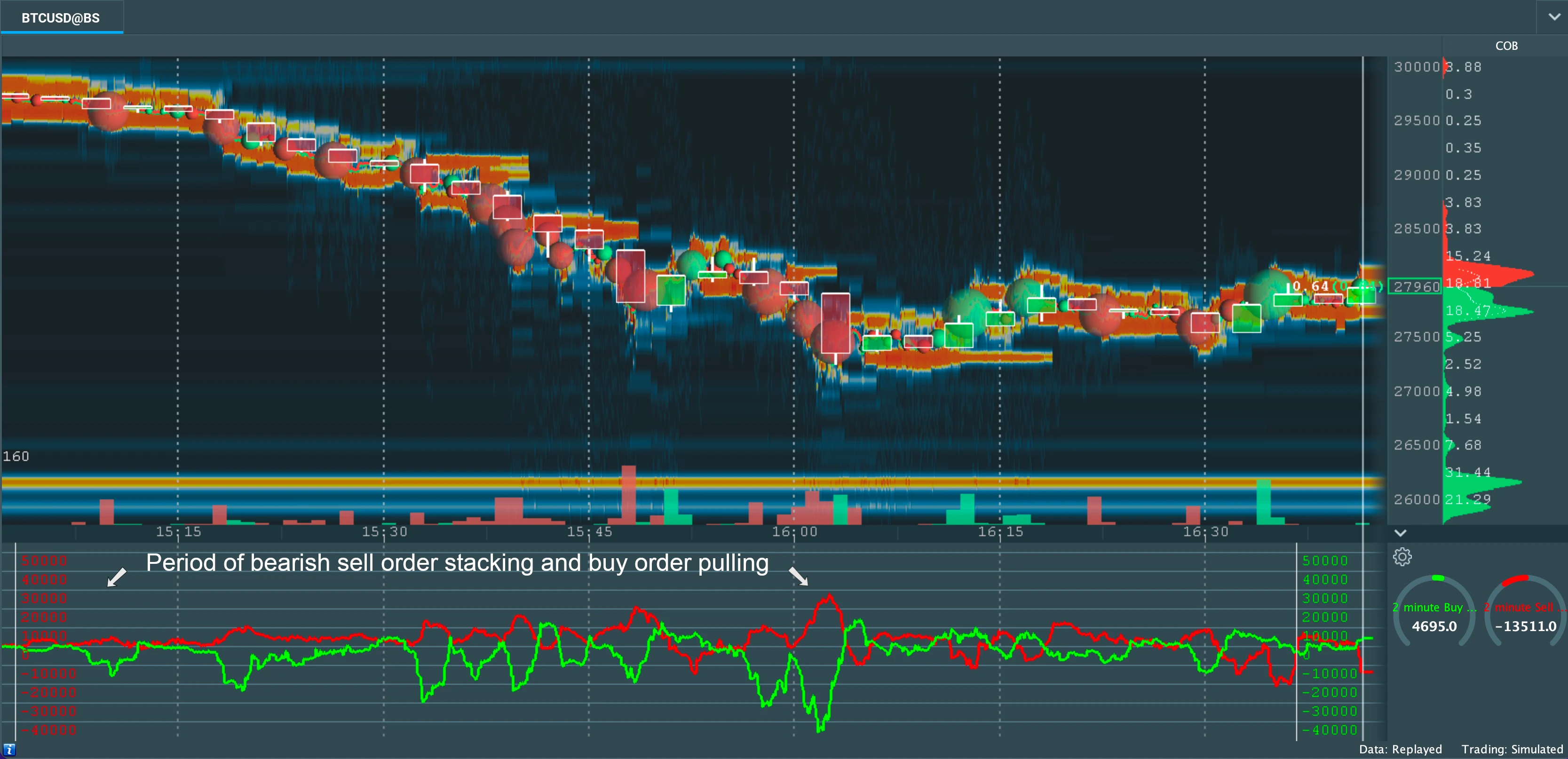

A rare shorting opportunity exposed by the Pulling & Stacking IndicatorA rare shorting opportunity occurred on April 26, 2023 when Bitcoin's value dropped 8% in less than an hour. Here we break down the event in simple terms using Volume, Price, and Order Flow analysis.  Price action: prior to 3:00pm Eastern time, Bitcoin's price action was relatively mundane for the day. After 3:00 pm, the price action moves considerably downwards with no relief until around 3:50 pm. At some point after the initial drop, a trader looking for a shorting opportunity is wondering, "how long will this price action continue?" We can look at volume and order flow for corroborating signals. Volume: we have configured Bookmap to show delta volume. The vertical bars at the bottom of the Bookmap represent buy volume minus sell volume. We see no significant buy volume delta until 3:50 pm. This corroborates the bearish price action signal from 3:00 to 3:50 pm. Order Flow: here is the signal which most people didn't notice. Sell orders were being stacked while buy orders were being pulled from the order book in excess until around 3:50 pm. This is visible via the Pulling & Stacking Indicator's horizontal line graph at the bottom of Bookmap. These are two bearish signals which, when corroborated with the bearish price action and delta volume, produce a very bearish signal. After 3:50 pm, buy and sell order pulling and stacking activity resumes oscillation and price action plateaus then makes a small recovery. Learn more about the Pulling & Stacking Indicator here. Result: consistent and corroborating bearish signals between 3:00 and 3:50 pm indicate a high confidence shorting opportunity. The Pulling & Stacking Indicator is available for download and purchase in the Bookmap marketplace. The Pulling & Stacking indicator is a tool for interpreting market activity, not as a tool that provides guarantees or certainties for future market activity. Order flow and other market patterns for a security may change at any moment regardless of prior indicators. Trading securities may lead to financial loss. Exercise caution when trading securities. No warranties or guarantees are provided. |

|